Votes Have Value!

2025 Magazine

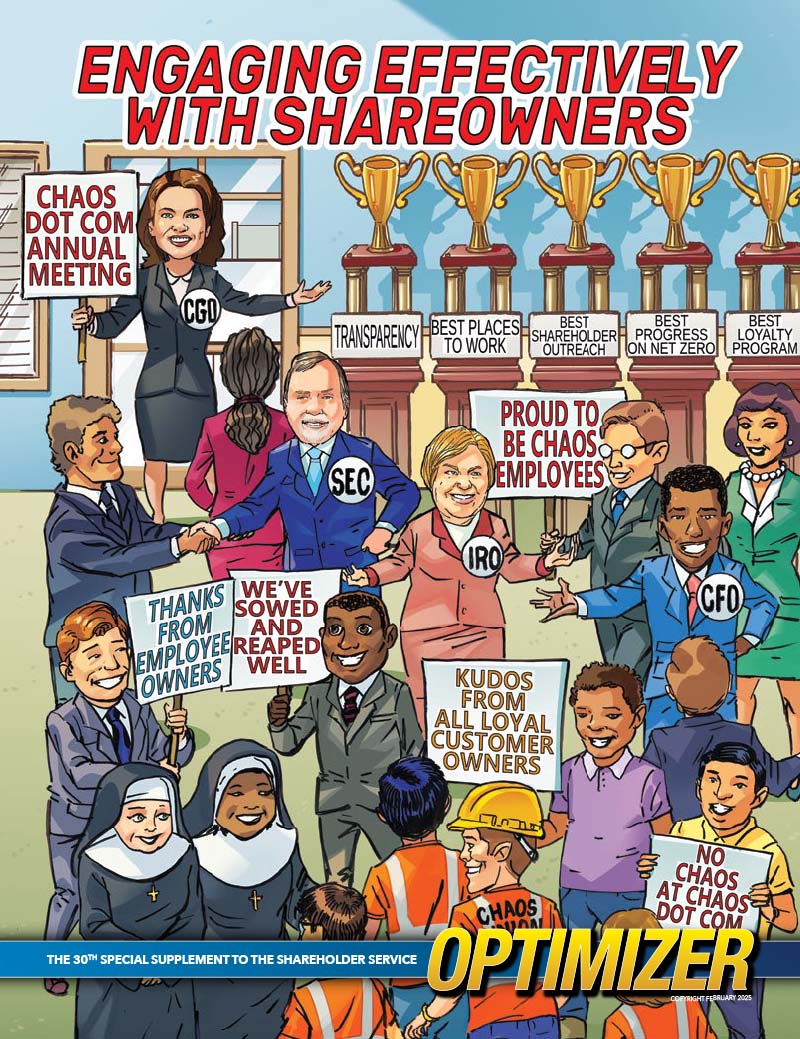

Engaging Effectively With Shareowners

Optimizer Online

Recent Articles

Leveling the Playing Field of Corporate and Shareholder Transparency

A Call to Action from Joseph Caruso, CEO, Alliance Advisors Joe Caruso: Over the past few years, there’s been a growing call for greater corporate transparency, especially from government agencies, institutional investors, and proxy advisory firms. But are we really creating a level playing field when it comes to shareholder transparency? OPTIMIZER: It seems that we’re still far from that....

Reflections on “Engaging with Investors”

Over the Past 30+ Years – And Advice for Effectively Engaging Now – From Two Pioneers of Good Corporate Governance When we announced the theme for this year’s Special Supplement to the OPTIMIZER—our thirtieth edition—one of our advertisers noted that “thirty years ago, the idea of ‘engaging with investors’ was virtually unheard of.” He was right! Back then, activist investors—and especially...

HARSH CRITICISMS OF RULES FOR PROPONENTS AND CONDUCT OF Q&A AT VSMs: HOW TO AVOID BEING NAMED AND SHAMED

“Shareholders promoting both progressive and conservative agendas say companies are increasingly trying to limit their voices at annual shareholder meetings—the one day of the year when boards are required to hear from the people who own their companies,” a recent posting by a Barron’s reporter asserted. “Attempts to assert that control has become easier as more companies hold online-only annual...

Big Transfer Agent Censured/Fined For Major Internal Control Failures

We wish we could say that we were shocked to read the long list of shocking findings by the SEC against Equiniti Trust Company, formerly known as American Stock Transfer & Trust Company. But readers, we have been very regularly warning transfer agents – and issuers too – about the huge liabilities involved in the business of transferring stock – and properly issuing new shares too - since...

PCAOB Report On Auditing Deficiencies Shows “Leveling Off” … But Still Shocking Percentages Of Failed Audits.

WILL BAD AUDITOR GRADES SPILL OVER TO YOUR AGM? PREPARE NOW, WE SAY We were greatly encouraged by remarks from the recently reorganized PCAOB board leadership promising much greater scrutiny of public company auditors and a much stronger focus on the number of audit failures at the top-four U.S. firms. But the latest report, on their studies of 2022 financial statements, where a Wall Street...

How’s This For “Forced Transparency”? Citi Adds New Section To Its QRS On Reorganization Efforts – Following SEC Inquiries – And Big Fines For Failing To Make Progress On Internal Controls

Our thoughts and prayers continue to go out to Citi CEO Jane Fraser as she struggles to rein-in the wild and reckless horse that Citi had become after more than a decade of ‘deferred maintenance’ on its key operating systems and their internal controls. But OUCH! As reported by Reuters in August, after being fined $136 million by bank regulators in June for making “insufficient progress” fixing...

How And When To Properly Open And Close The Polls

Over the last two years a mini-debate broke out sporadically over LinkedIn on how best to manage the opening and closing of the polls. Many activist investors felt that they should remain open until after the general Q&A period - and ideally, until the very end of the Meeting - so voters would have time to change their minds if something they heard rubbed them the wrong way. Quite a few...

A Few More Observations From The 2022 Meeting Battlefront – And Some “Problem Areas” To Note

The problem of “meeting congestion” on the busiest meeting dates continues to be a growing issue for issuers - and for their key suppliers: We predict that issuers will increasingly have to vie for favorable meeting dates and times, since at best, there are only eight hours in a given day when companies can safely hold their meetings without riling up shareholders - and directors too. So start...

Morrow Sodali Celebrates 50 Year Anniversary By “Building Together”

The OPTIMIZER interviews Adam Frederick, Global President, Bill Ultan, Managing Director – Corporate Governance and Greg Reppucci, Senior Director– Sustainability & Corporate Governance Through a combination of savvy strategic acquisitions and a continued focus on internal personnel growth and technological innovation, Morrow Sodali has been at the center of the most urgent and critical...

Will ‘Big Brother’ Really Be Looking At Your VSMs This Year?

We have been reporting on comments from ISS - and from several large investors as well - that they would be monitoring Virtual Shareholder Meetings to assure that shareholders will have a meaningful chance to ask questions - and to “engage in a dialogue with management” - and will consider voting against some or maybe even all directors in 2023 at companies that fail to meet these objectives. So...

When Pigs Fly

Ever hear this old expression, to indicate a totally unlikely event? Well damned, if pigs aren’t indeed flying high - on the proxy voting front! More kudos to Liz Dunshee for reporting that activist investor Carl Icahn’s fight for the rights of pregnant pigs not to be confined to cramped “gestational pens” will move forward to votes at McDonalds - and at Kroger, where Icahn is putting two...

The 2022 Season Starts Out With A Big Bang

As Liz Dunshee reported in her March 13 blog, “This voting outcome arrives at the same time that the UN Environment Assembly has agreed to negotiate a legally binding treaty to tackle plastics, which many are calling the next ‘Paris Accord.’ That comparison is significant because the targets in the Paris Treaty jump-started the focus on emissions. Meanwhile, other companies are proactively...

Shareholder Services: History

Carl Hagberg

The Shareholder Service OPTIMIZER, first published in 1994, is “dedicated to helping public companies – and their suppliers – to deliver better and more cost-effective services to shareholders”.

Get the Optimizer!

Subscribe to the Optimizer quarterly newsletter and bonus annual magazine - packed with investment insight, interviews with industry leaders, and much more!

The OPTIMIZER comes with the promise of "some free consulting on any shareholder relations or shareholder servicing matter to ever cross your desk.

Share

Share the Optimizer with your colleagues!